ICTSI Valuation Update

An update on the Philippines port operator's valuations

Last year June, I published a 13,500-word deep dive into International Container Terminal.

In my deep dive, I explained why I believed ICTSI is one of the greatest businesses in emerging markets. It operates several ports in emerging and frontier markets, from the Philippines, Mexico, Brazil, to more challenging markets like Madagascar, DR Congo and Iraq. In the past, it also operated ports in Syria and Sudan!

I also admire its founder, Enrique Razon Jr., who I believe is one of the best operators leading a publicly listed company today - (the Warren Buffett of ports!)

If I could own any company in the world outright, it would be ICTSI. That said, even with my personal bias and “favouritism” towards ICTSI, one still needs a reality check on its valuations, and yesterday, its shares crossed our “6% IRR hurdle rate”.

For new readers, my investment process is guided by IRR hurdles over a 5-year investment period. After researching a business, I estimate an intrinsic value based on the facts I’ve learned, and do the following:

>15% IRR - purchase shares when I estimate a minimum IRR of at least 15%.

<6% IRR - At 6%, I begin taking some gains, typically reducing my weighting by half.

<3% IRR - At 3%, I commence exiting the position, regardless of my personal bias towards its business.

The strict IRR targets helps me remove the emotions from investing. Yesterday, ICTSI’s shares breached the <6% IRR hurdle rate, after a 60% rally in the past year and a 50% rally since I published its deep dive.

My thought process by no means aims to anticipate what its share price will do in the near term; last month, I discussed why I exited Alphabet. A month later, its share price has since accelerated even higher!

While I certainly don’t provide financial advice to you, the readers, I’m still aware that what I publish could influence your investment decisions and thus try to be as transparent and detailed in my investment analysis (hence the very lengthy deep dives!).

While I remain optimistic about its shares, ICTSI is no small business as it was years ago. Giant port concession acquisitions that could once move the needle are no longer as plentiful as they were, and the competition for these port concessions is as fierce as ever, just as we saw in its recently finalised South African Durban port debacle.

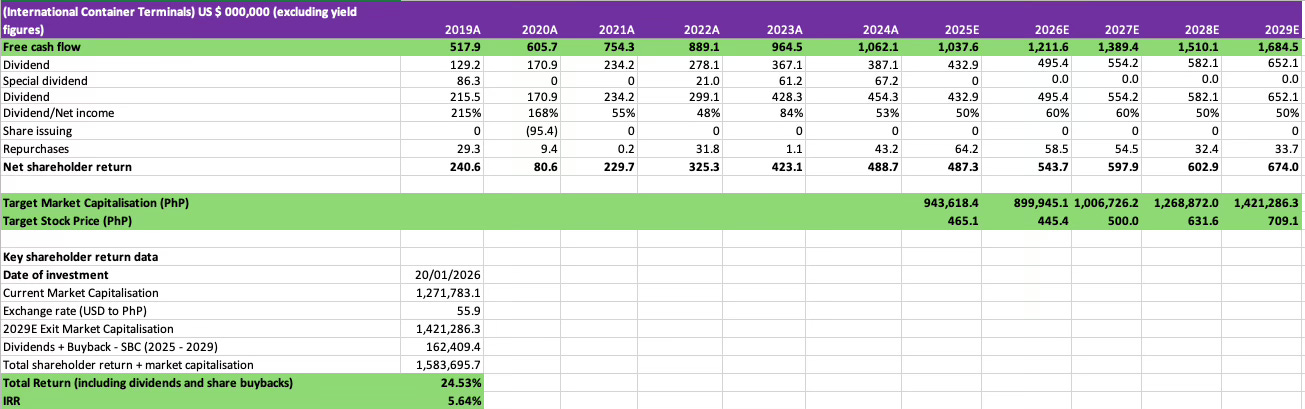

The updated ICTSI valuation model below, as shown, applies today’s market cap (Ps. 1.27 trillion) and estimates a 5.6% IRR from here to 2029, the investment case exit year.

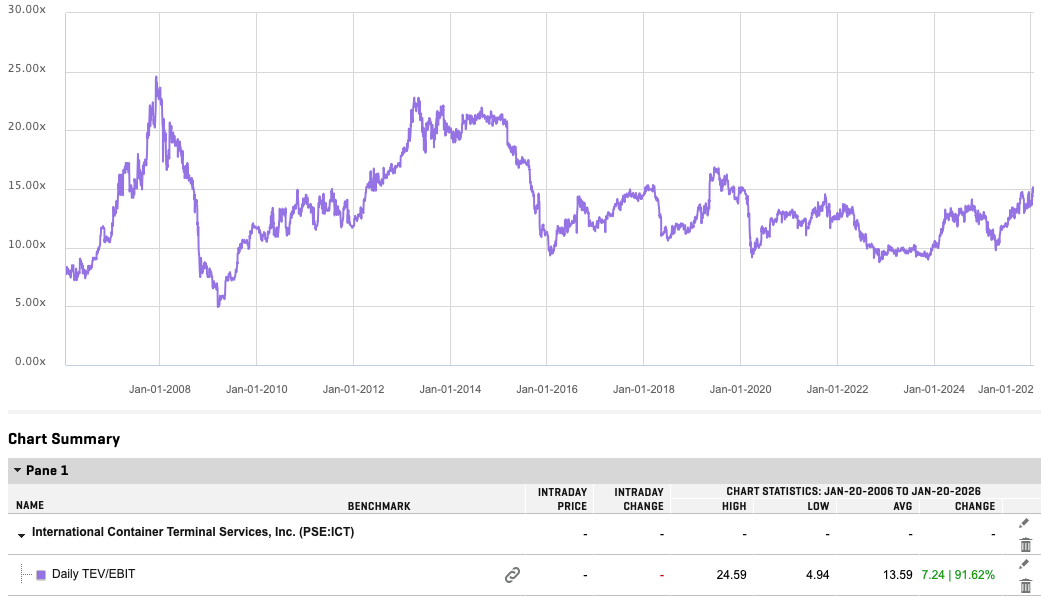

To further support our analysis here, the chart below presents ICTSI EV/EBIT over the past 20 years and as presented, its EV/EBIT has averaged 13.6x, versus 15.2x today. When I began researching ICTSI for the deep dive, it was 10x EV/EBIT.

In the near term, I’ll be following ICTSI’s company and earnings updates. I believe they’d handily beat the 2025 estimates I had initially anticipated - the Manila ports tariff increased higher than I expected, the Philippine peso devaluation supports earnings growth, and the Mexican price per TEUs remained higher than I expected.

After its Q4 2025 and annual earnings reports, you can expect me to update our models and will update the newsletter should there be any material changes to its investment case. For now, hold to reduce.

Excellent report on ICTSI. Razon is actually known as a bully in many PH business circles lol, he's been in many fights and his businesses are inducive to these things. He has really good government connections which is often required to compete effectively.

The transparency in these shared information is valuable for understanding consequential investment decision executed. Close monitoring should ensure a buy decision in a most timely price position. Do you also estimate when this position will be reached on a near-term investment horizon ?