Most investment write-ups begin with bullish arguments. Here, I’ll flip the script.

Let me walk you through five reasons not to invest in TSMC, the world’s largest semiconductor foundry. Or why you might even want to short its stock.

Taiwan

The bearish case starts with the name itself. Taiwan is one of the most volatile geopolitical topics of our time. I recently pitched TSMC to a mentor of mine. Before I could even explain my investment case, he cut me off and said, "I could never put my money in Taiwan." He isn't alone in this view. The world's greatest investor, Warren Buffett, bought and sold TSMC only a few months later for a similar reason.

2. The 3-year cycle

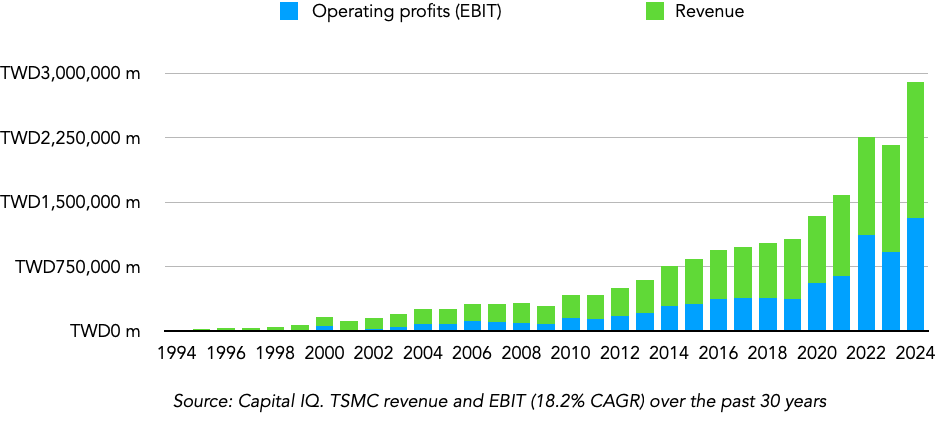

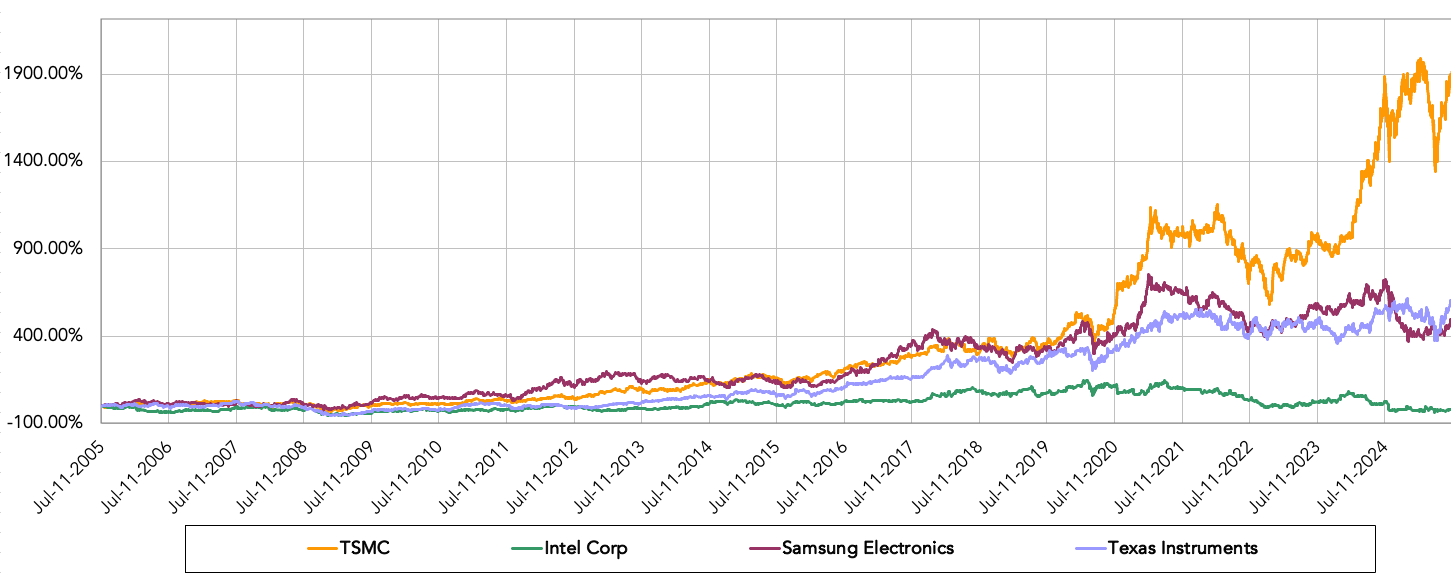

In the past 30 years, TSMC’s revenue and operating profits declined nine times, nearly once every three years. During periods of technological booms, as we are experiencing with AI today, it's easy to forget just how cyclical the semiconductor industry is, which leads to the next bearish case.

3. The AI bubble?

I'm a firm believer in the power of AI and its potential to transform humanity, industries, and companies. I previously covered how AI created one of the most important companies today, Alphabet. But while I see its potential, what if technologists and society have taken the AI boom too far too quickly?

After all, history shows that civilisation has repeatedly over-hyped technological advancements in the short term. If this is the case, TSMC is undoubtedly among the losers, given its role in manufacturing chips essential for AI. TSMC similarly played a significant role in the internet bubble. In 2001, after the bubble burst, its revenue declined by 24%, while EBIT fell by 77%. It took three years (2004) for TSMC to return to its previous profit highs. History could repeat itself, and the key question is to what extent it will.

4. A generalist in a specialist’s world

As a generalist investor, I stay within my circle of competence. Luxury goods? Airports? Ports? I understand how the products and services are developed and how they compete in their industries. But semiconductor fabrication at 3 nanometers? That's another level of technical complexity and getting it wrong can be costly.

5. A crowded investment

TSMC represents nearly 10% of the MSCI Emerging Market Index and many EM fund managers are forced to purchase TSMC shares. From a conversation with a friend, not owning TSMC has almost been a career risk for many EM fund managers. While this doesn't impact fundamentals, it could highlight TSMC as a crowded investment with little room for potential upside.

These five points are each valid concerns and risks I will address in the deep dive. For full disclosure, I recently purchased shares in TSMC at Jenga IP, and I have a different conclusion. That said, one must understand TSMC from a balanced viewpoint and in this two-part deep dive, I’ll cover the following:

History of TSMC: An overview of TSMC over the past four decades and an assessment of factors that have contributed to its success. A case study assessment of TSMC during the tech bubble bursting and progress since the mid-2000s.

Taiwan in focus: Perspectives on Taiwan, its edge in technology, the government’s role in supporting the semiconductor industry and the current state of its competitiveness.

The global foundry industry: Assessment of the competitive landscape in the chipmaking industry, insights into Intel, GlobalFoundries and Samsung, and broader growth drivers.

The semiconductor ecosystem: A review of key equipment and software suppliers, the chipmaking process, nature of their relationship and customers across TSMC's technologies like Apple and Nvidia, case study on supplier relationships with ASML and Applied Materials and its broader value chain.

Business economics: Analysis of TSMC's revenue and cost structure, Capex and depreciation economics, unit economics per wafer and fab, and its trend through the years, across technologies and relative to peers.

Growth drivers: Assessment of current fab expansions and new fabs, insights into TSMC's Arizona efforts, N2 chips, CoWoS, and broader advanced packaging, as well as perspectives on the High Performance Computing (HPC) division.

Risks and challenges: Thoughts on geopolitics, technology risks, customer concentration, state of its pricing power and the semiconductor cycle.

Valuation: Revenue and earnings projection for TSMC over the next five years, thoughts on its current valuation relative to peers.

1. History of TSMC

One of the ten quality attributes I assess in companies is the value created for society - does it make customers healthier, happier, or more productive? To what extent is society better off with its products and services, and how difficult is it for rivals to replicate its value add to society? Here, TSMC scores 9.7/10 in the Jenga IP Quality ranking sub-category (the highest among all companies I've studied so far) and an overall quality score of 80/100 (high moat company). Its manufacturing techniques and innovations have served as the backbone of the Internet age. Over 15 billion devices are powered by TSMC chips each year, and more than 60% of the world's chip design companies rely on TSMC for manufacturing.

TSMC is far from an overnight success. The success of TSMC is attributed to several individuals across both the public and private sectors. To truly appreciate the central theme in TSMC, its deep moat, we need to understand its history and how a small country of 36,200 km² gave birth to one of the largest companies globally today.

Taiwan before TSMC. Pre-1987

A common misconception is that Taiwan's semiconductor efforts and investments only began in 1987, when Morris Chang, TSMC's founder, established the company. While several events occurred before the creation of TSMC, three particularly stand out;

The creation of the Industrial Technology Research Institute (ITRI) in 1973

The technology transfer from Radio Corporation of America (RCA) in 1976

The founding of United Microelectronic Corporation (UMC) in 1980

Taiwan, for the three decades before TSMC’s founding, had long reaped the benefits of industrialisation, growing its nominal GDP 65-fold between 1960 and 1987, from $1.6 billion to $105 billion. Taiwan quickly became a powerhouse in the textile, footwear, steel and petrochemical industries during those years. It later identified the fast-growing high-technology industry as its next phase for manufacturing growth. The Ministry of Economic Affairs, led by Sun Yun-suan, who would later become the Premier of Taiwan, founded ITRI in 1973.

ITRI served as the platform for Taiwan's semiconductor efforts, and a couple years later, they partnered with the US RCA for a technology transfer. Under this agreement, Taiwan paid RCA $1 million per year, and in return, RCA trained several staff members from ITRI and shared several semiconductor and integrated circuit manufacturing techniques. The initial 19 engineers included the likes of Bob Tsai (former UMC chairman), M.K. Tsai (former MediaTek chairman), and F.C. Tseng (former vice chairman of TSMC), which demonstrates the effectiveness and success of the RCA partnership in Taiwan.

Source: ITRI. ITRI and RCA signed a technology transfer and licensing contract in 1976.

Six years later, in 1980, UMC spun off from ITRI and created its semiconductor path, validating the ITRI model. Afterwards, the Taiwanese government doubled down on its investments and resources in supporting the semiconductor industry. One of the key strategies employed during this period, the early 1980s, was to encourage several Taiwanese engineers to return to the country, and one of them was Morris Chang.

A friend recently asked me if I could have dinner with any three people of the past century, dead or alive, who would they be. My answer? Charlie Munger, Lee Kwan Yew and Morris Chang. Many of you would agree with these three people, well, at least in your top ten.

Morris Chang, the founder of TSMC, was born and raised in China but moved to Hong Kong during the Second World War and later to the US to study at Harvard University and then MIT. Morris Chang had risen through the ranks at Texas Instruments (TI) over a 25-year career (ended 1983). While at TI, he'd noticed the manufacturing success Texas Instrument's Japanese factory was achieving - twice as productive as Texas Instrument's domestic factories. In an interview, he mentioned that the Japanese technicians were more qualified and had lower turnover, concluding that the future of advanced manufacturing will be in Asia.

As we recall, in the early 1980s, Taiwan was also growing its interest and efforts to recruit experienced executives from the semiconductor industry. Following a meeting with Hsu Shien-Siu, the then-current president of ITRI, in 1985, Morris Chang agreed to relocate to Taiwan and lead ITRI.

At ITRI, although the organisation had already successfully spun off UMC in 1980, Morris Chang viewed ITRI as too academically driven and wanted to reorient ITRI more towards industry. However, due to cultural clashes between his American-style business practices and the Taiwanese approach, very little was achieved, and instead, Chang was occupied with fulfilling requests from integrated circuit companies to build semiconductor fabs and after much pondering, he concluded the best approach would be a pure-play foundry, entirely focused on making chips to other companies.

As you can see, these early building blocks, including the government's vision, foreign technology transfer, talent repatriation, and visionary leadership by Morris Chang, formed the foundation of TSMC's moat. The barriers to entry and resources required for success are immense.

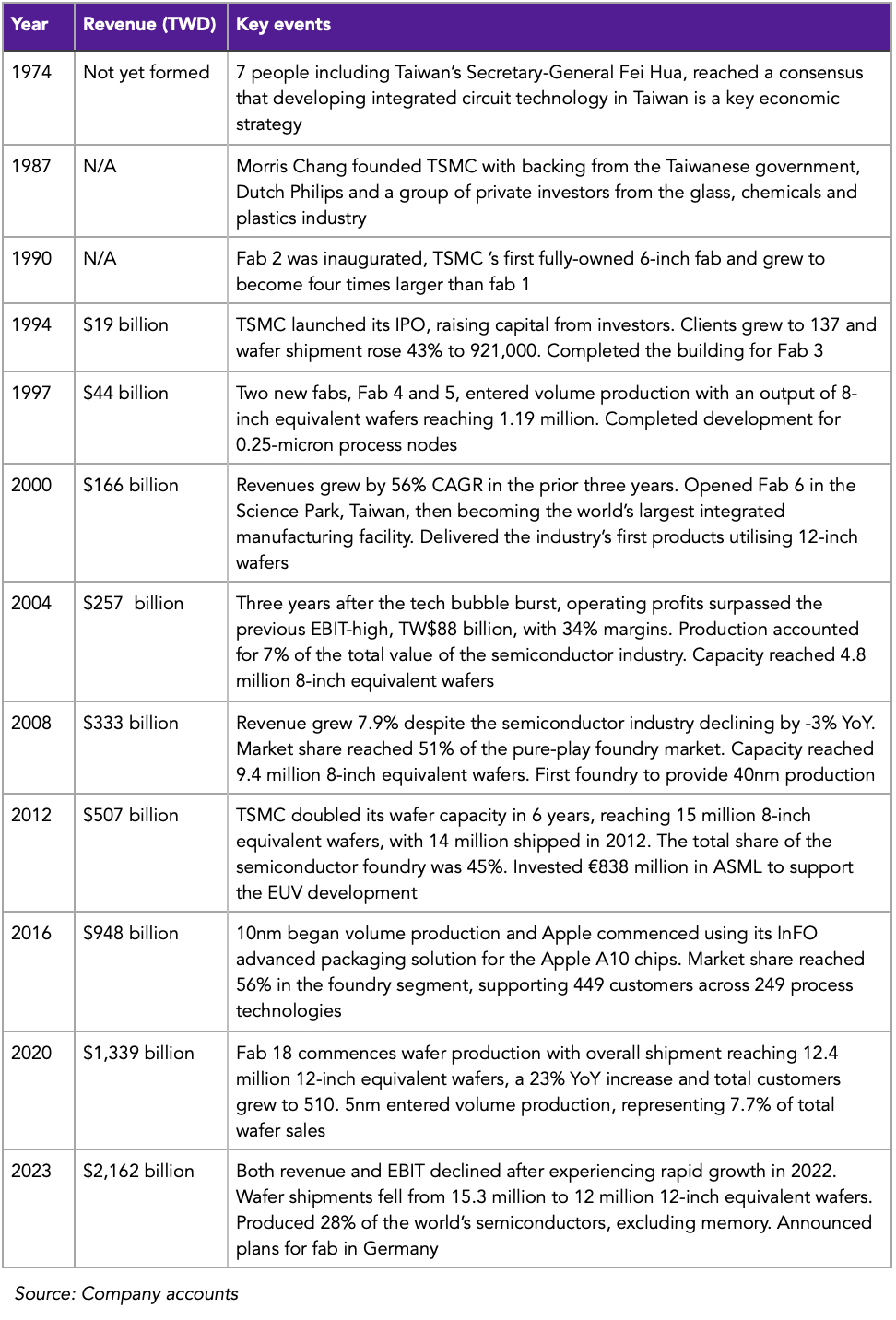

TSMC 1987-2000

With Morris Chang as the driving force, he needed partners, both financial and non-financial. After some convincing, the government agreed to invest 48% ($70 million) of the required capital to launch TSMC and Morris Chang needed to find additional partners from both the semiconductor industry and the local private investor network. In the former, Morris Chang reached out to many international companies, including his old employer, Texas Instruments, but the only company interested in investing was Philips ($58 million), a mid-tier semiconductor manufacturer based in the Netherlands. Philips was interested in Taiwan’s low-cost labour and concluded that investing in TSMC would be a good way to enter the region.

Note that Philips has since restructured its business operations, and its semiconductor division has evolved into NXP Semiconductor, primarily focused on automotive, industrial, and communication infrastructure. NXP continues to have a joint venture with TSMC in their Singaporean-based fab and the upcoming German fab.

Even with local private investors, Morris Chang encountered some difficulty, and it wasn't until the Taiwanese premier intervened that investors like Wang Yung-ching of Formosa Plastics Corporation committed to contributing capital ($35 million).

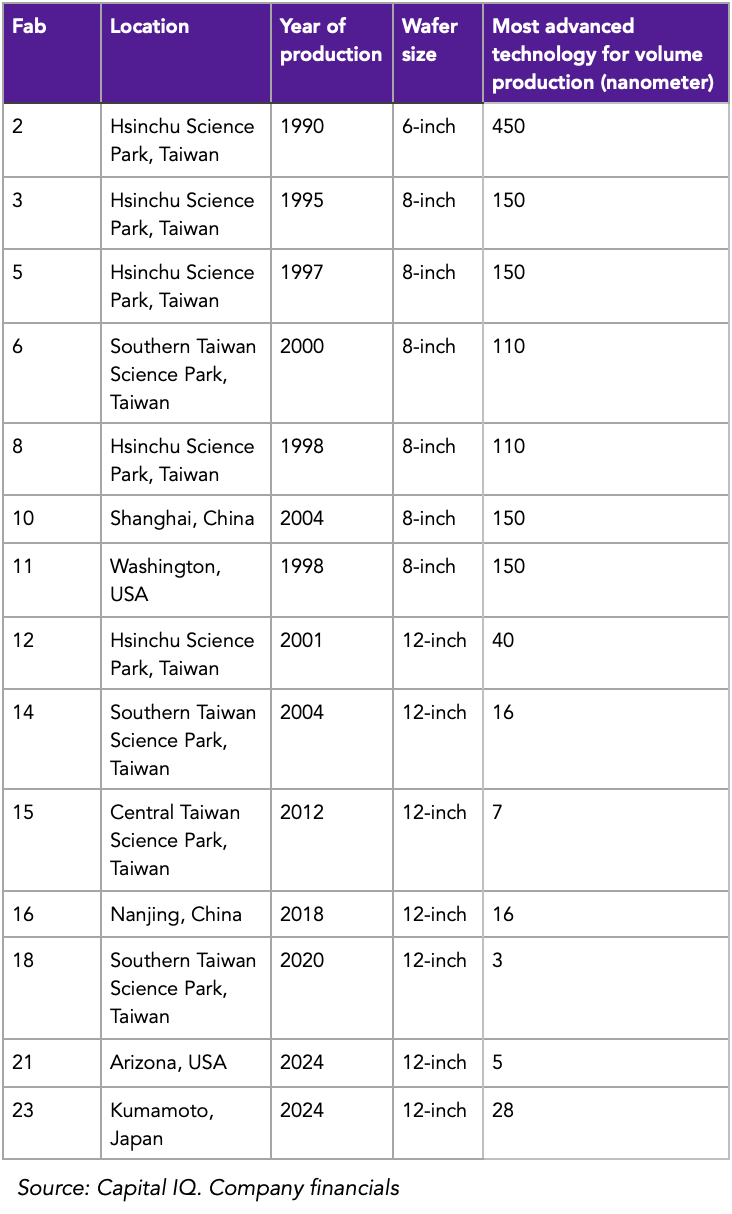

With the required resources now secured as of early 1987, building TSMC wasn't a smooth sailing. Morris Chang still held his role at ITRI and hired Jim Dykes as the initial CEO of TSMC, only to fire him a year later. Signing American and European clients initially proved difficult, so TSMC initially catered towards Taiwanese semiconductor companies. Its first fab, fab 1, was a converted research lab leased from ITRI in Hsinchu Science Park, Taiwan. Following the success of customised 3.0-micron node technology (defined by the size of the nodes) for Philips, more international semiconductor companies partnered with TSMC, notably Intel.

TSMC’s fab 1

Over the next few years, TSMC saw its operations and technical expertise expand. By 1994, a year it went public on the Taiwanese Stock Exchange, revenues had reached TW$19.3 billion ($735 million), with EBIT margins of 45%. TSMC had also reached 137 customers, including companies such as Fujitsu, NEC, and Siemens, among its top clients. Meanwhile, sales were growing twice as fast as the broader semiconductor market while recording wafer shipments of 643,000 6-inch equivalent wafers.

For the second half of the 1990s, TSMC set its ambitions to build a second fab in 1995 (Fab 2A and Fab 2B) and later Fabs 3, 4 (now discontinued), and 5 by 1997. Between 1994 and 2000, TSMC's revenue and operating profits grew at 43% and 38% CAGR, respectively. By 1999, while Philips was still a key customer, representing 3.7% of TSMC's revenue, other customers, such as Nvidia (6% of revenue) and Altera (6.1% of revenue), had surpassed Philips's revenue share, indicating that the Taiwanese foundry had now outgrown its Dutch partner.

Case study - the tech bubble

“Semiconductors are like gasoline. Prices go up and down, but people are always going to buy them.” Donald Brooks, President of TSMC. Bloomberg 1994 article

Depending on who you ask, we are either in a bubble or the most significant technological leap of the past decades. I'm not going to analyse or discuss where exactly we are, as time will tell. Instead, it is more important for investors to reflect on previous bubbles and how TSMC could face a worst-case scenario.

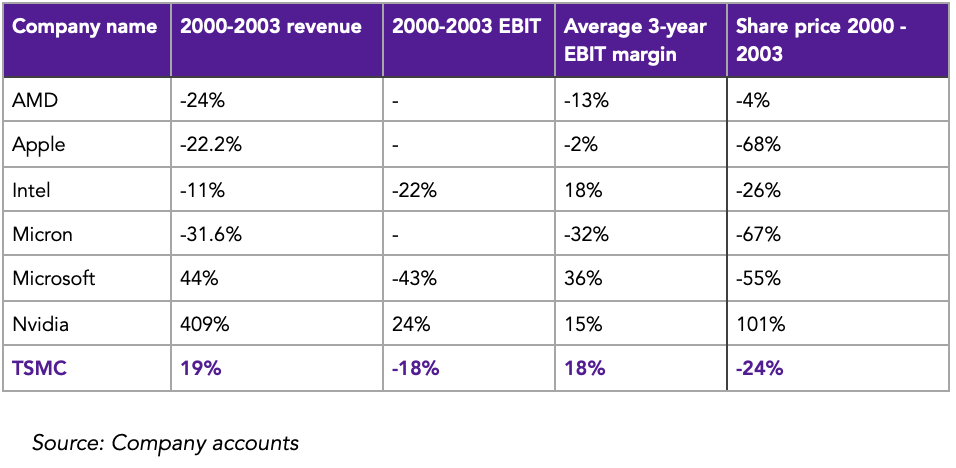

The tech bubble wrecked many technology and internet companies and given TSMC's integral role in manufacturing chips, it wasn't immune from the challenges. In the table below, I highlight how TSMC performed relative to some of the major technology companies in terms of revenue, EBIT, and share price change between 2000 and 2003.

Of course, these figures are meaningless in today's world, given how these companies have changed since the early 2000s; Microsoft wasn't SaaS-based, nor did it have a cloud division, Apple hadn't invented the iPhone or app store, and Intel was still the giant of the semiconductor world.

The purpose of reflecting on these numbers is to provide some context on how TSMC performed during the worst of the technology bubbles. TSMC itself hasn't changed much since then. It still makes chips on a contracted basis but has a much larger market share and a greater focus on leading-edge chips.

Of course, its business model is cyclical, as we'll discuss later in the risks and challenges section, but as you can see, during the worst three years, its operating profits declined by only 18% while revenue managed to grow by 19%, unlike many other semiconductor companies. From an operational lens, Morris Chang admitted to overextending during the tech bubble, a mistake that TSMC reflected on as being more disciplined with - TSMC's fabs utilisation decreased from 106% in 2000 to 51% in 2001. Chang moved quickly to correct that mistake, as Capex declined by 64% between 2000 and 2003.

2004 - present

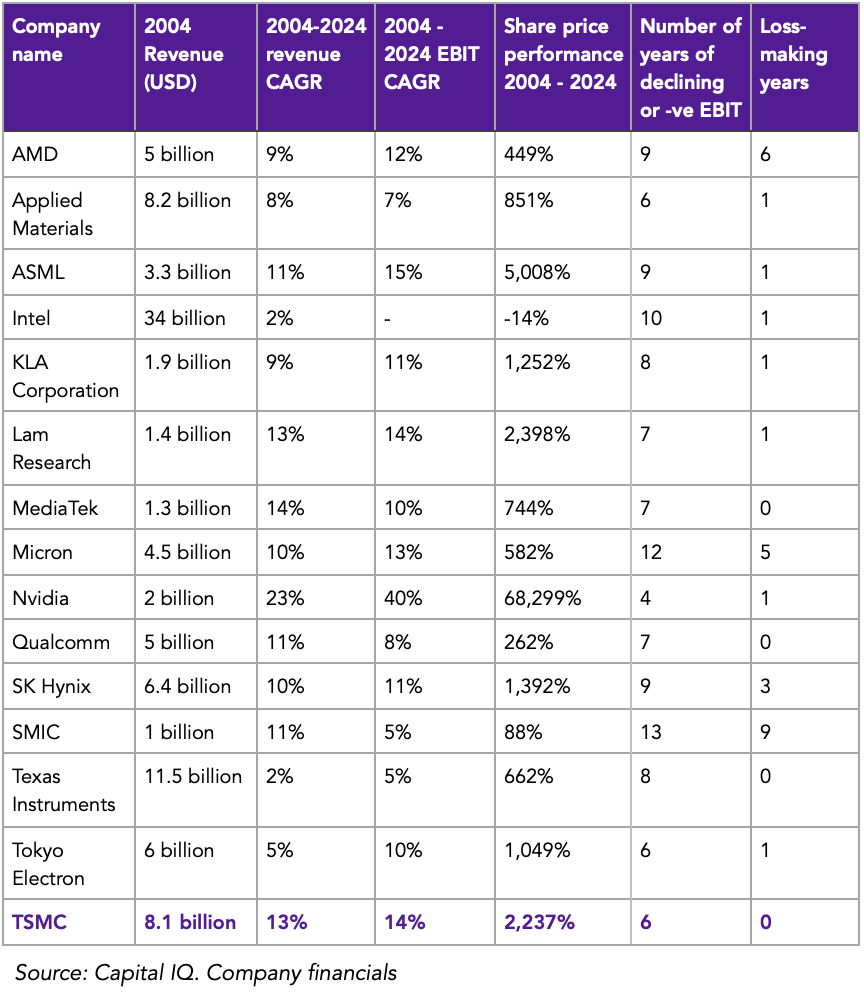

By 2004, TSMC had already become the fifth-largest listed semiconductor company by revenue and the second-largest by operating profits. They established the fabless model for the majority of the semiconductor industry except for companies like Texas Instruments, Renesas Technology (JV between Hitachi and Mitsubishi), Infineon Technologies (spun off from Siemens) and STMicroelectronics.

In the table below, I highlight the revenue and EBIT growth rates, as well as the share price performance, over the past 20 years of the 15 largest publicly listed semiconductor companies. Among the 15, TSMC, despite being one of the more mature companies by size, grew its revenue and operating earnings at the third-fastest rate among all 15 companies.

A particularly noteworthy data point is TSMC's consistency in a cyclical industry. Among the 15 companies, only 4, including TSMC, have never experienced a loss-making year. If we extend this to 1991, the earliest available report, TSMC remains the sole company among all 15 with such a track record of profitability consistency. On average, TSMC experiences a slowdown in operating profits every 3 years, with six such instances in the last 20 years, which is the second-best record among all 15 companies. Only Nvidia has done better.

From exploring TSMC's history, there are three important points I'd want to leave you with that form a key part of my long-term investment case for TSMC:

The Barrier to entry: The TSMC story required several stars to align: Morris Chang's vision for semiconductor manufacturing, the Taiwanese Ministry of Economic Affairs, and the generosity of RCA and Phillips in technology transfer (a scenario unlikely to recur), as well as Taiwan's economy. It's extremely difficult to replicate this. In my view, given the resources, talent and political support required, only a Chinese company could replicate TSMC's success in semiconductors in the future. I will discuss competition from China's SMIC later on.

Track record: Very few companies can organically grow their earnings by 18% per year for 30 years. Only 10 companies globally with a current market cap above $50 billion have achieved this, and more impressively, TSMC has achieved this without a single loss-making year.

Focus, focus, and focus: The 37-year TSMC journey has been predominantly organic-growth driven, without any major acquisitions of other foundries or fabless companies. TSMC is entirely focused on leading the chip world in productivity and innovation. Beyond chips, TSMC once ventured into and invested in solar PV manufacturing but ceased operations in 2015 due to concerns over capital allocation.

2. Taiwan in focus

As discussed earlier, Taiwan's economic strategy and early focus on semiconductors were key contributing factors to TSMC's success over the decades. However, beyond simply highlighting the industry, other factors have also contributed to TSMC's success in the region.

Taiwan’s R&D Investments

Taiwan (3.98%) ranks third, only behind Israel and South Korea in R&D as a percentage of GDP. Taiwan's public-private collaboration in R&D, exemplified by institutions such as ITRI, Academia Sinica, and the National Applied Research Laboratories, has been a model for many countries for years. Its major companies, including TSMC, have been key beneficiaries of this collaboration. Since founding the ITRI, Taiwan has implemented several initiatives to support R&D and industry across electronics, manufacturing, biotechnology, and semiconductors and has seen many of these projects convert into actual companies.

2. Science Parks

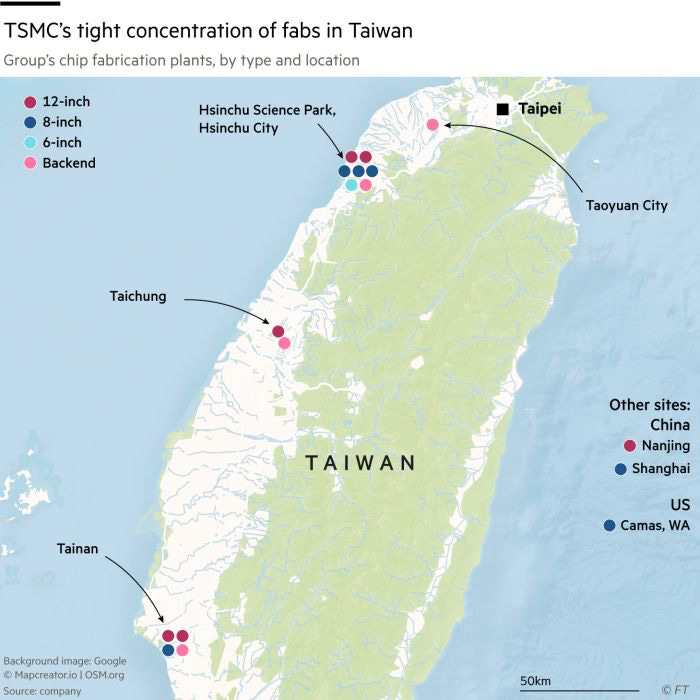

There are numerous factors and considerations when building semiconductor fabs, and over the years, Taiwan has invested in several science parks, which have been a key factor in boosting TSMC's capacity utilisation and ease of access to broader resources across its supply chain. The main science park, Hsinchu Science Park, built in 1980, hosts 5 of TSMC's current 14 fabs, while the Central Taiwan and Southern Taiwan Science parks host four other TSMC fabs.

Source: CECI Engineering Consultants. Hsinchu Science Park aerial view

Beyond their fab-grade energy and water utilities (TSMC accounts for 5% of Taiwan's energy consumption), their proximity to top universities like National Tsing Hua University (a 10-minute drive from the Hsinchu Science Park), streamlined construction permits, network effects and positive feedback loop given the presence of several partners in nearby facilities contribute to TSMC's performance and efficiency. Despite being significantly smaller than its peer group, the Taipei-Hsinchu science cluster is currently ranked 27th globally in terms of output.

Source: Financial Times. TSMC has 9 fabs in Taiwan, at three science parks.

3. STEM education

One of Morris Chang's insights from his time at Texas Instruments that lured him towards a career in Taiwan was the fact that he noticed manufacturing productivity at TI's operations in Asia was much higher than those in the US. Taiwan, like the rest of the Asian Tigers, has invested a sizeable amount in education, particularly in STEM courses and degrees.

Since the 1970s, Taiwan has implemented various strategies to support STEM education. Initially, the key strategy was brain gain, sending students to the US via government scholarships. However, over time, the government transitioned its strategy to be more inward-facing by investing in local engineering and science departments, while also bringing academia and industry closer together through initiatives like ITRI, as discussed earlier. TSMC's local access to talent is a limiting factor in its current push to create more global fabs beyond Taiwan, which highlights the importance of surrounding factors in building a TSMC.

These factors have, of course, contributed to TSMC's economics and moat, making it difficult for new players to establish competitive fabs, as they would be competing with 60 years of Taiwan's investments in chip manufacturing, as well as TSMC's investments since its inception. The flip side is the geopolitical situation with China, which I will discuss in the risks and challenges segment.

Taiwan key stats

Taiwan’s R&D to GDP of 3.96% is the third highest in the world

Total personnel employed in R&D per thousand total employment is 14.5, one of the highest globally

Taiwan ranks 2nd globally in number of patents filed per capita

Taiwan has the second-highest concentration of ranked universities per capita in 2024 QS World University ranking

High-tech manufacturing accounts for over 60% of Taiwan’s industrial production

3. Global foundry and semiconductor industry

As part of my investment process, I split the world into 60 industries and ranked them on seven key variables. While not central to the TSMC investment case, you can read more on this here. Among these 60 industries, two are semiconductor equipment (14th of 60 industries by ranking) and semiconductor services (19th of 60 industries by ranking). This was a surprise to me, given the reputation semiconductors have for being ultra-cyclical.

More interestingly, one of the seven metrics, the presence of outperformers, explores the track record over the past 40 years in which an industry produced an outperformer. Here, the semiconductor equipment industry was the 5th best-performing sub-industry of all 60 industries.

At the bottom half of the presence of outperformers was the semiconductor services sub-industry, where TSMC and other contract manufacturers and design companies are located, ranking 34th out of 60 companies, as it produced only 17 outperformers out of 537 listed companies.

While this sounds slightly negative for investing in semiconductor service companies like TSMC, further analysis of the data reveals a key trend: the winners of the past tend to remain winners in the future, with limited room for new players. Due to the technical capacity, R&D budgets, and oligopolistic sub-market structures in these manufacturing and broader services segments within semiconductors, as well as the business model complexity (which often requires hardware, software, and services), the broader barriers to entry are quite robust.

If one examines the sub-markets within semiconductors dominated by companies founded in the 21st century, they tend to be in very niche markets, e.g. Bitmain in Bitcoin mining ASICs (Application-Specific Integrated Circuit) or operate at very high loss margins to compete with the 20th-century players, e.g. Cerebras Systems in AI custom silicon chips (competes with Nvidia and made an operating loss of $134 million on $79 million revenue in 2023).

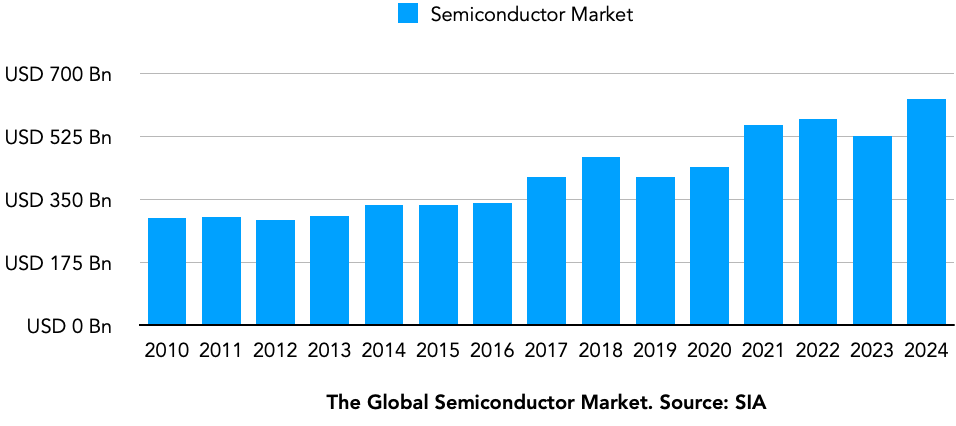

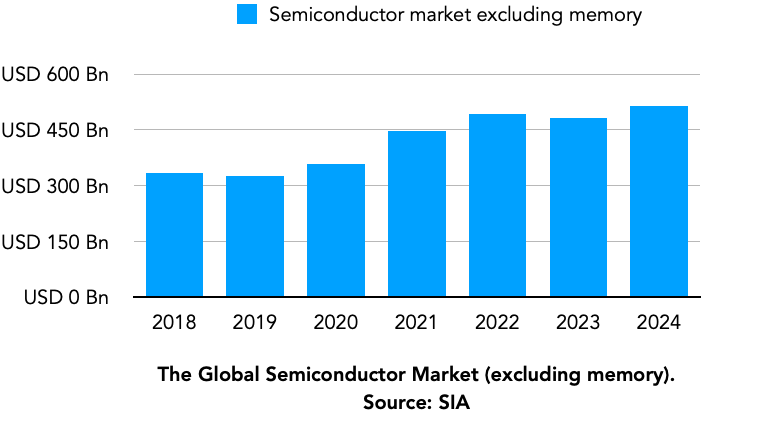

Beyond the difficulty of entering the semiconductor market, a key point is its long-term growth potential. According to SIA, the semiconductor market has grown overall by 5.47% over the past 14 years, reaching $628 billion in 2024, with its growth rate accelerating in more recent years.

For TSMC, the more relevant market is the non-memory and foundry market, given its focus on logic and, to a smaller degree, embedded memory chips. According to the table below, the growth rate in the ex-memory chips market was slightly faster between 2018 and 2024, growing at 7.5% compared to 5% for the broader industry during the same period.

Unlike memory, the logic chip segment has more room for product differentiation and innovation, which allows newer chips (<7nm size nodes) to be materially more expensive than older chips.

Pure-play Foundry services

Until the 1980s, the majority of semiconductor companies had their own fabrication facilities (fabs), but research by Lynn Conway and Carver Mead on Very Large-Scale Integration (VLSI) ushered in a new approach for the industry, making chip design substantially easier for companies to operate without fabs. At the same period, Morris Chang, while at TI, had envisioned a contract manufacturing service to semiconductor companies by building independent fabs. His idea, however, was rejected by TI and formed the basis of TSMC. Today, it's estimated that between two-thirds of all chips are manufactured by pure-play foundries.

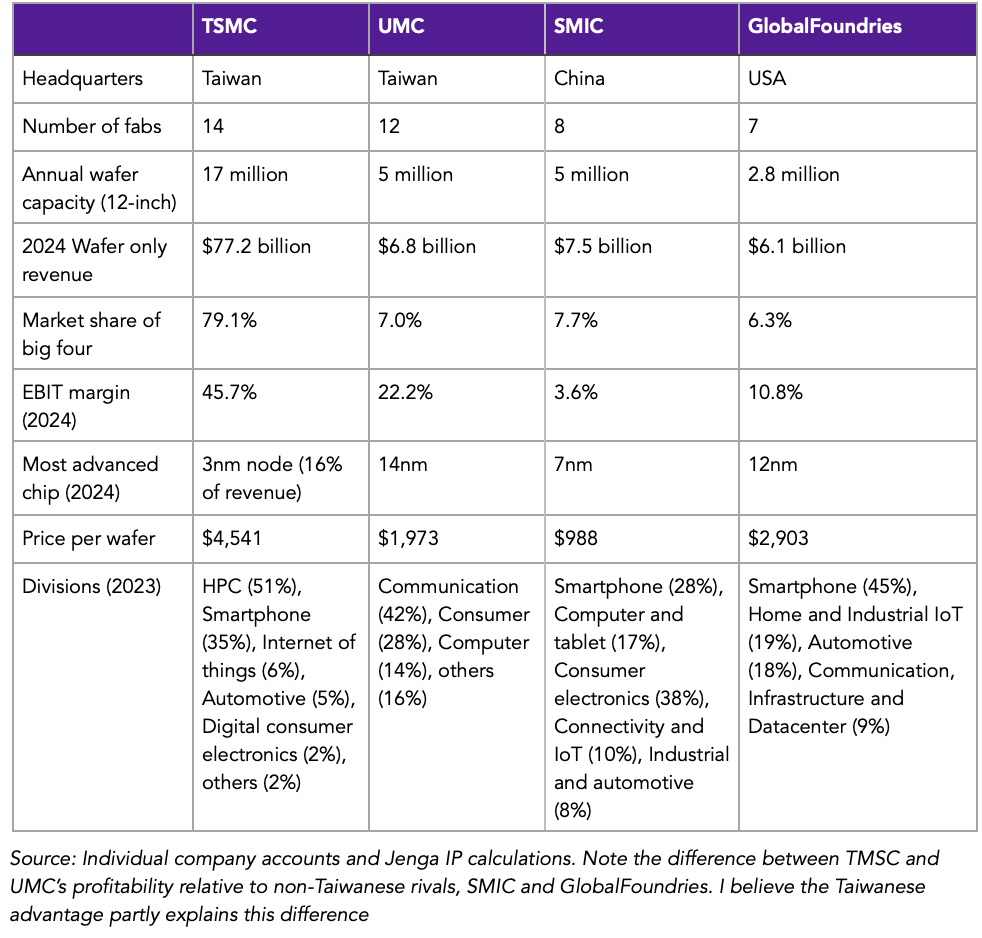

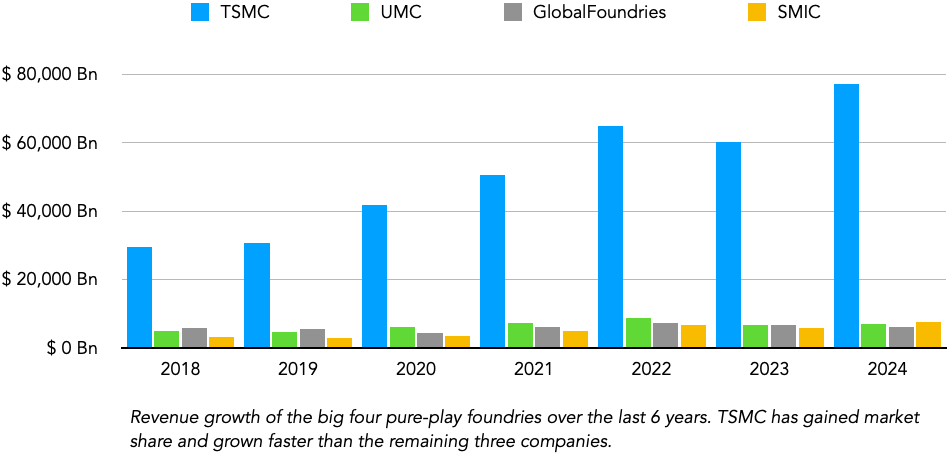

The overall foundry market is estimated to be around $250 billion, but two sub-market segments are more relevant to TSMC: the leading edge market in competition with Samsung and Intel and the pure-play market, where TSMC competes with three major players, UMC (I discussed their spinoff from ITRI earlier), Semiconductor Manufacturing International Corporation (China) and GlobalFoundries (USA).

The pure-play foundry Big Four

In the table below, I compare the big four pure-play foundries on key metrics and statistics, including their wafer-only revenue, number of fabs, price per wafer, and how they split their divisions, among others. As you can see, TSMC's economics, chip node focus, and market share are significantly ahead of the rest of the foundries. Only SMIC, the Chinese-based foundry, is in the leading-edge segment of sub-7 nm chips.

It's also important to examine the price per wafer gap; TSMC's wafers are significantly more expensive than the average wafer made by its other pure-play foundry peer group, which highlights how critical and beneficial it is to be the most innovative (at mass production) in the industry as these innovative, leading chips earn much higher revenue and profits per wafer.

In its 2024 annual report, TSMC expanded the definition of its addressable market from foundry 1.0 to foundry 2.0, which increased its market share from $150 billion to $250 billion. Foundry 2.0 encompasses areas of the chipmaking process, including advanced packaging and integrated device manufacturing, with key players such as Samsung and Intel highlighting the competition between them has intensified in recent years.

Intel and Samsung

Intel and Samsung are the key competitors for TSMC, and each has its varied business model. Among the three, Samsung is the most vertically integrated player, being the largest memory chip manufacturer globally. It is estimated to be the second-largest player globally in the foundry leading-edge market, with a roughly 15% market share, compared to TSMC's 60% market share.

Intel, also vertically integrated, have been the pioneer in semiconductors, particularly in personal computer applications. The key question over the past decade from an industry dynamics lens has been whether the benefits of being vertically integrated, like Samsung and Intel, outweigh TSMC's more focused strategy in pure-play foundry.

The answer depends on who you ask, but from my research, there are a few changes that have made the industry dynamics shift in favour of TSMC's approach:

Rise of Apple and mobile computing: In the pre-2012 world dominated by Windows-based computing as the primary form, Intel's position at the top was more solidified, but the rise of Apple and mobile computing significantly impacted Intel's position. Just like Microsoft, Intel failed to adapt its business models to mobile computing as new players, such as ARM's architecture ecosystem and Qualcomm (with its Snapdragon brand), entered the market alongside vertically integrated mobile players like Apple, Samsung, and Huawei.

Additionally, Samsung, a key competitor to Apple in the smartphone market, compelled Apple to reduce its dependence on Samsung for chips. In 2014, Apple began shifting production to TSMC, given TSMC's independence from the rest of Apple's businesses. If Android devices, led by Samsung, were to regain market leadership in the smartphone market (accounting for 35% of TSMC's revenue), this would significantly alter the industry structure at the chip manufacturing level. (Note: TSMC is the leading manufacturer of Qualcomm's Snapdragon chips, which also leads Android phones).

SK Hynix, ARM and Nvidia: While we haven't seen any material new players in the various oligopolistic markets within semiconductors, both Intel and Samsung have faced increased competition in recent years. In the DRAM memory market, for example, SK Hynix, for the first time, surpassed Samsung's leading market share in Q1 2025 (36% versus 33.7%). In the architecture segment, while Intel still maintains market leadership, Arm's RISC architecture, which already dominates mobile computing, continues to gain share in personal computing.

Custom chips: Another key industry trend of recent years is the rise of ASICs (Application-Specific Integrated Circuits). The key growth market in recent years for TSMC is its High Performance Computing division, which has grown from 29.5% of its total revenue in 2019 to 51% in 2024, a 36% 5-year CAGR, versus the 13.5% CAGR for the rest of TSMC's divisions. In the world of AI, efficiency, performance and scalability have become increasingly important. To compete, several AI hyperscalers, including Google (TPU), Tesla (Dojo) and Microsoft (Azure Maia), create their own custom chips but don't fabricate them.

These compute workloads would have traditionally been powered by CPUs from players like Intel, but with hyperscalers now designing their chips and outsourcing the chip production process, pure-play foundries like TSMC capture the value instead.

The rise of Nvidia and AI chips: The most significant impact over the past three years has been the rise of Nvidia - the role that GPUs play in AI and data centres, a sub-market that Intel had neglected. Nvidia and TSMC have established a win-win partnership and I recommend an interview between TSMC's founder, Morris Chang and Nvidia's founder, Jensen Huang here. Over the past 20 years, Nvidia has been a key customer of TSMC; in 2003, Nvidia was TSMC's largest customer, accounting for 15% of TSMC's sales. I'll discuss the Nvidia and TSMC partnership in greater detail in the growth and risks segments later in this article, but it's important to note that Nvidia's success in AI benefits TSMC the most.

Overall, it's clear that the technological industry has become less monopolistic compared to the 1990s, when there were only a few major players (Microsoft and others). In this environment, being a focused specialist like TSMC offers a more significant value proposition than in the past. At least the chip manufacturing area.

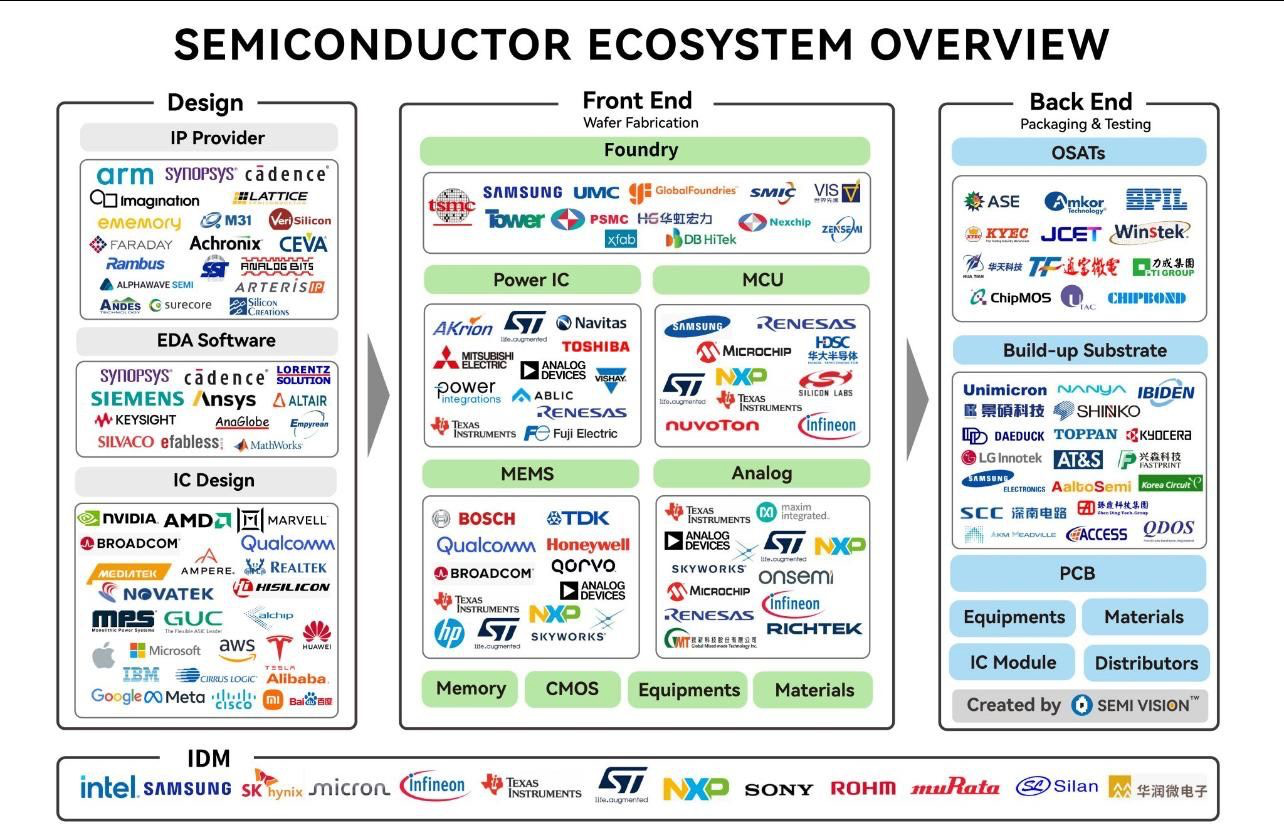

4. Semiconductor Ecosystem

Thoroughly analysing the semiconductor ecosystem requires a separate, in-depth article, so here, I'll focus on areas key for TSMC. There are three crucial relationships for TSMC: equipment & tools suppliers, fabless and IDM customers and chip software designers & architecture providers. I'm particularly optimistic about investing across the semiconductor ecosystem, not just TSMC, due to the maturity and oligopolistic nature of each stage, which has developed over the past two decades.

Between 2020 and 2023, I invested in KLA Corporation, one of TSMC’s equipment suppliers, which taught me just how developed and sticky existing players are - TSMC couldn’t potentially swap KLA’s equipment used for inspecting chips very easily. As a result, the overall ecosystem is broadly collaborative and stable, with limited room for ecosystem shocks.

Customers

Manufacturing chips involves thousands of processes. The chipmaking process can take nearly four months, from the finalisation of chip design to the final inspection and testing. I will explore this process later in this section. The chip design phase, where TSMC’s customers collaborate with architecture providers like Intel and ARM, as well as chip software design companies (Electronic Design Automation - EDAs), can span anywhere from 6 months to 2 years, with multiple product iterations.

The chipmaking process is the most integrated manufacturing process in the world, and TSMC's role as a fab gives it a crucial role in the semiconductor ecosystem, bringing customer designs, tools & equipment together to build the required chips.

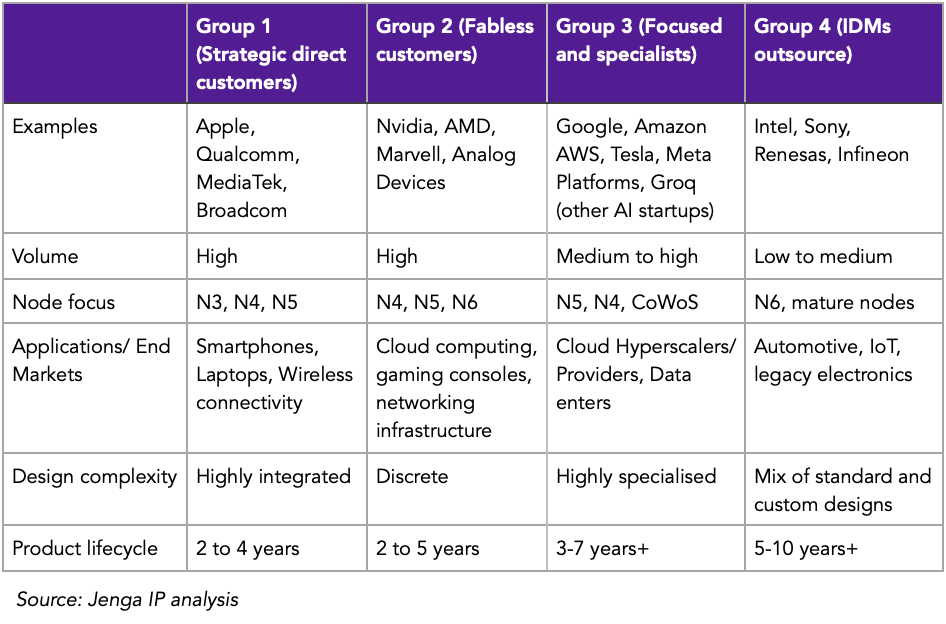

Across TSMC’s customers, there are four key group types;

Strategic direct customers e.g. Apple, Qualcomm, Broadcom, MediaTek

Fabless customers, e.g. Nvidia, AMD, Marvell and Analog Devices

Focused and specialist customers, e.g. Google, Amazon AWS, Tesla, Meta Platforms

Integrated Device Manufacturers e.g. Intel, Sony, Renesas, Infineon

Each of these customer groups has its own characteristics, and in the table below, I share the typical features of each group.

Group 1: While TSMC doesn’t share the data at the customer-specific level, I estimate group 1 customers (Apple, Qualcomm, MediaTek, etc), strategic direct customers, represent just under half of TSMC’s total revenue, led by Apple (A and M series chips) and Qualcomm (Snapdragon chips). These customers tend to utilise TSMC’s leading-edge chips.

Group 2: TSMC fabless customers have been a staple customer base for them over the past decades, and with the exponential growth of Nvidia in recent years as a customer category, they’ve regained their high share of TSMC’s total revenue. The nature of their end markets has shifted slightly from gaming consoles and PCs towards cloud computing and AI applications in recent years. Like the Group 1 strategic customers, these customers also utilise TSMC’s leading-edge chips.

Group 3: Since Google’s custom-made chips, TPUs, launched in 2015 with TSMC’s 28nm node, technology companies with large resources have become a small but growing customer base for TSMC. These are typically used in AI applications at their data centres. Among its peers, TSMC dominates this space.

Group 4: Integrated Device Manufacturers (IDMs), by nature, have their foundries and typically outsource some capacity to TSMC, usually in their lagging-edge chips (28nm and older), due to internal supply constraints. For TSMC, IDMs are opportunistic customers, often outsourcing selectively when internal fabs hit capacity limits. I estimate that the four (Intel, Sony, Infineon and Renesas) are less than 5% of TSMC’s total revenue, while others, including Texas Instruments and NXP Semiconductor, make the whole category around 15% of TSMC’s revenue. Note that TSMC stopped reporting the revenue split between fabless and IDMs in 2017; IDMs were then 20% of TSMC’s total revenue.

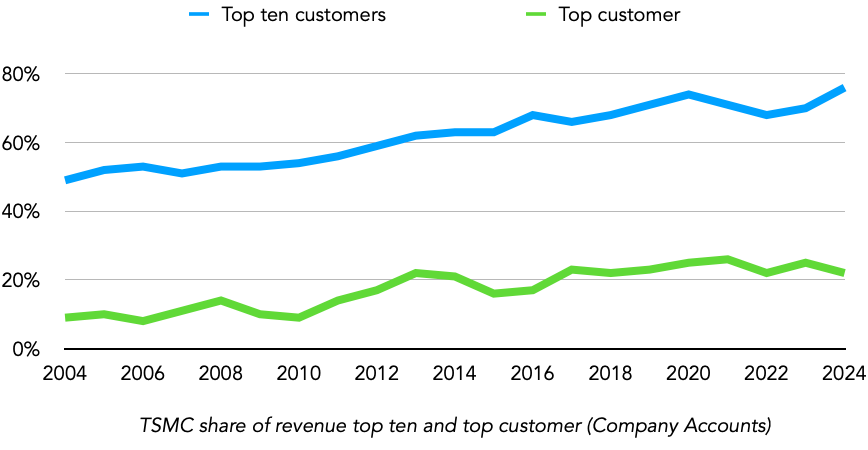

Overall, TSMC had 522 customers at the end of 2024, but the top 10 customers represent the sheer majority of their revenue base. In 2022, 2023, and 2024, TSMC's top ten customers accounted for 68%, 70%, and 76% of revenues, respectively. In the chart below, I present the trend in the share of top customers and the top ten customers over the past 20 years. Of course, this is a significant risk; A problem for Apple is, in effect, a problem for TSMC. However, TSMC cannot do much about this because each respective end-customer electronics market is similarly oligopolistic; thus, volumes will be dominated by the largest players.

Customer case study 1: Apple

Three years after the launch of the Samsung Galaxy phone, it became clear to Apple that its reliance on Samsung posed a significant risk. Apple had used Samsung products for application processors, flash memory, LCD panels, and other discrete components. By 2014, Apple began shifting some production (A8 chips) for the iPhone 6 to TSMC, using its 20nm nodes. The following year, Apple faced a “chipgate” controversy, as the company had relied on both TSMC and Samsung-made chips. Notably, the iPhone 6/6s made by TSMC was known to have better battery performance than Samsung's. After that, Apple adopted a TSMC-only microprocessor chip model starting in 2016 with the A10 Fusion chips.

The relationship has been fruitful for both companies, as Apple quickly became TSMC's largest customer for years. Morris Chang shared insights into his meeting with Apple's COO, Jeff Williams, on an Acquired podcast. TSMC invested $9 billion and deployed 6,000 workers round the clock to complete Apple's first large-scale order within 12 months and since then, it's been a win-win relationship. With Apple's guaranteed purchases, TSMC scales new technological nodes at a much quicker pace than in previous years.

From an investor analysis lens, I use the TSMC-Apple relationship as a barometer for TSMC's innovation and execution. If Apple were to announce shifting a sizeable portion of chip production elsewhere, this would be a significant concern for me regarding TSMC and could prompt me to sell its shares.

Source: TSMC is the sole manufacturer of Apple’s chips

Customer case study 2: Nvidia

With Nvidia's explosive growth in recent years, one might think they only recently became key customers of TSMC; however, the relationship between the two companies dates back to the 1990s, when Nvidia was still in its early days. TSMC was an influential foundry partner when it introduced the world's first GPU (Nvidia GeForce 256) in 1999. By 2001, Nvidia already accounted for 17% of TSMC's revenue.

In more recent years, as Apple has become more integral to TSMC, the preferred buyer status has led Nvidia to explore alternatives, such as Samsung, to fill production gaps. Monitoring how TSMC manages these relationship challenges will be crucial, as it is expected that Nvidia could regain its position as TSMC's largest customer from Apple by 2025. Nvidia's rebound is driven by its central role in AI training and cloud services.

Equipment and service suppliers

TSMC's customers are just one-half of its semiconductor ecosystem, and an equally important half is the suppliers who make the tools, parts and services required for TSMC to deliver on performance for customers. We can split these suppliers into five groups;

Facility and infrastructure

EDA & IP architecture providers

Tools and equipment providers

Materials

Backend and packaging partners

Facility and infrastructure partners and suppliers aren't exactly part of the semiconductor ecosystem, but it's often overlooked just how vital these partners are for TSMC, given the technical and critical nature of the fabs. Typically, the physical buildings, cleanrooms, and utility systems can account for anywhere from 10% to 20% of a fab's construction budget. By nature, these are also the most localised, but it's common for TSMC to use their Taiwanese partners in international fabs. For example, the Taiwanese-listed United Integrated Services, a longtime TSMC partner, announced contracts from TSMC's Arizona fabs, with over $2.5 billion in cleanroom-related contracts in 2025.

Other crucial partners here include Taiwanese-listed companies such as Yankey Engineering, Acter Group and L&K Engineering. Over the past 5 and 10 years, an investment in these four companies has returned a 35% and 24% CAGR, respectively, demonstrating the long-term profitability of being a TSMC facility supplier.

Materials suppliers are similarly not exclusive to the semiconductor ecosystem, but they provide key chemicals, speciality gases, and consumables required in the chip manufacturing process. Materials can be categorised into facility-wide and wafer-specific categories, with the former having a direct impact on production costs. I estimate that they account for 80% of the overall materials costs. There's a range of materials required, but the most important are the wafers (10-15% of wafer costs GlobalWafers, Shin-Etsu, SUMCO), the Extreme Ultraviolet (EUV) photoresists, which I will explain shortly - 12-15% of wafer costs - Fujifilm, Tokyo Ohka Kogyo and JSR Corporation) and deposition gases (Air Liquids, Linde and Merck).

A simplified chip manufacturing process

Starting with silicon wafers: The starting point is the procurement of silicon wafers from one of the three suppliers: GlobalWafers, Shin-Etsu or SUMCO.

Cleaning to perfection: Next, TSMC engineers clean the wafer to remove any contamination. There's a multi-step cleaning process involving numerous chemicals, typically provided by Taiwanese and Japanese companies.

Building tiny transistors: The next stage is where TSMC builds the transistor layer (the brain of the chips) on each wafer.

First, they engrave (or etch, in industry terminology) trenches where transistors will be built, then fill them with oxide to isolate each transistor. Key suppliers for the etching tools are Lam Research and Applied Materials.

Adding special layers: To define how fast and power-efficient the transistor switches are, TSMC will deposit ultra-thin insulating layers (technically referred to as high-k dielectric and metal gates). Tool suppliers include Applied Materials and ASM International. At the more advanced 2nm (scheduled for mass production in H2 2025), this is highly critical.

Using advanced light technology: Further etching and patterning are performed with the highly complex Extreme Ultraviolet Lithography tool developed by ASML. Patterning is the process of transferring the circuit designs into the silicon wafer using light.

Before patterning, the wafers are coated with photoresist (supplied by Fujifilm and JSR Corporation), which reacts to light. The photoresist and lithography processes must be matched, and ASML often develops equipment hand-in-hand with the photoresist material companies.

Further transistor building process. Source-drain formation. Electrons need to flow around for the chips to function. The source is where electrons enter. The drain is where they exit, and the gate controls whether the flow is allowed or blocked. Special atoms (dopants) are done via ion implantation. In advanced chips like 3nm and 2nm, TSMC grows new silicon crystals with dopants already in them (technically called epitaxy).

There's a range of suppliers involved in the steps above, including ASM International and Applied Materials for the complex epitaxy process, as well as gases from Air Liquide and Linde.

Controlling electron flow: The gate, which controls the switch to turn each transistor on or off, is built using very complex components like a High-k Dielectric layer (made from hafnium oxide, introduced to chipmaking from 45nm nodes) and special metal gates, which goes on top like a sandwich and helps conduct electricity better. Suppliers include Applied Materials, Lam Research, and ASM International for deposition tools, as well as Honeywell and Merck for metal materials.

Now, the transistor structure is fabricated, and TSMC isolates each transistor from the others by adding insulating materials around the gate and performing further etching at the source/drain regions. Suppliers include Lam Research, Applied Materials and Linde for gases.

Connecting everything: By now, the transistor is fully formed, and the next phase is to connect everything into a circuit, which is done by wiring up the transistors with over 15-20+ layers of metal wiring. The key supplier is Applied Materials.

Testing the wafer: Before cutting, each chip is tested to separate good from bad chips. Further inspection is conducted to ensure that every layer is perfect and there are no defects, as this impacts performance. KLA, ASML and Applied Materials.

Cutting into chips: The wafers are then cut into individual chips called dies. Suppliers of dicing tools include Disco Corp and Accretech.

Packaging and final testing: Finally, each die from the previous step is taped into protective cases (TSMC performs advanced packaging in-house), and then, once fully packaged, the chips undergo stress testing and simulation using real workload tools. Here, key test platform suppliers include Advantest and Teradyne.

Shipping to customers: The chips are then shipped to customers like Nvidia, AMD and Apple.

Readers familiar with the semiconductor industry may find this summary oversimplified, given the industry's inherent complexity. However, even in this simplified view, it's clear that a diverse range of customers and partners is essential, highlighting just how interconnected and collaborative TSMC's supply chain and the broader industry truly are. TSMC has a broadly positive relationship with most of its suppliers. For most semiconductor equipment suppliers, such as KLA Corporation, Lam Research, and Applied Materials, TSMC represents anywhere from 10-40% of their total sales, making them quite reliant on TSMC.

Supplier case study 1: ASML

In step 6 of the chipmaking process above, while I briefly highlighted ASML's role, it underscores just how critical ASML and its EUV process have become for the leading-edge chipmaking process. TSMC began using EUV in mass production in 2019 with its 7nm+ nodes, and with the 5nm in 2020, EUV application significantly expanded.

TSMC wasn't the first to use EUV. Samsung beat TSMC by a few months in this area, but TSMC moved more aggressively afterwards. The EUV technology was years in the making, and the big three — Intel, TSMC, and Samsung — each invested in ASML in 2012 to support R&D for its next-generation technologies. While Intel invested the most, TSMC ultimately became the largest beneficiary, which insiders attribute to the unique partnership culture present at TSMC, unlike that of its peers.

ASML's equipment is costly, with a price tag of nearly $400 million for each new EUV system, and requires multiple jumbo jets for transportation. ASML works closely with customers like TSMC to assemble and develop these. In the 2024 ASML annual report, management highlighted TSMC as its sole customer case study, showcasing meetings and fab visits in Taiwan.

Today, TSMC accounts for approximately a third of ASML's sales, and a good proxy for investment intensity will be the share of revenue across the big three players (TSMC, Intel, and Samsung).

Source: ASML. Their EUV’s are highly complex machines and integral for TSMC

Supplier case study 2: Applied Materials

Applied Materials is one of the better-managed semiconductor equipment suppliers across TSMC's supply chain. They provide materials and equipment critical in several stages of the chip manufacturing process and have been a key supplier to TSMC since the 1980s when TSMC was founded. Both companies have worked closely in developing new process nodes, with Applied Materials often being selected as TSMC's excellent technology collaborator.

With just over two-thirds of their total revenue coming from Foundry and Logic customers, TSMC was Applied Materials' largest customer until 2023. In 2024, Samsung (15% of revenue) overtook TSMC (11% of revenue), which, in some ways, signals Samsung's growing bid to capture market share from TSMC.

Source: Applied Materials. Staffers at an Austin facility in 2007

Seems all crucial aspects of a moat barrier is at play for TSMC.

What may remain of concern are:

- the stage of maturity the market to trigger future growth and increased profitability

- unexpected shifts in technological advancement of which the Palantir technologies phenomenon may yet be a springboard

Finally, a watchful surveillance must be kept by the investor on Chinaaof the possible final outcome of a seeming unsolvable problem: guarantee of perpetual sovereignty of the little Island state. This will remain a ticking timebomb and continuous risk analysis consideration, which will require agile and immediate proactive "sell" action by the acute investor

Very well-rounded analysis, looking forward to the next chapter:)